For anyone living in a community association, especially in a condominium association, it is crucial to keep everyone informed about significant developments that directly impact the community and its financial management. In recent times, the property insurance landscape has undergone substantial shifts and challenges that are influencing premiums, coverage, and the overall availability of insurance policies for a condominium association. These challenges are not unique to condominium associations in St Louis, but are widespread across the United States, leading to increased concerns in securing adequate insurance coverage.

Most critically, nearly all insurance companies are now strictly requiring updates to older electrical systems. This includes:

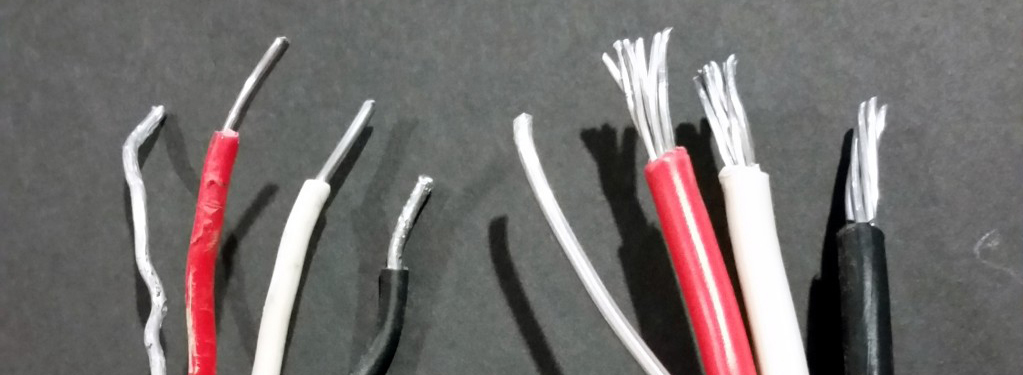

· Remediating aluminum wiring using AlumiConn connectors, per the Consumer Product Safety Commission recommendations.

· Replacing hazardous electrical panels, including, but not limited to: Federal Pacific Stab-Lok, Zinsco, GTE Sylvannia, and Challenger brands.

We understand the importance of maintaining adequate insurance coverage to protect your property and investments. In Missouri, State law and your condominium association’s governing documents also require that certain levels of coverage are maintained. Additionally, banks and lenders require that the association meet their own insurance requirements–failure to do so may result in Owners being unable to obtain loans on their Units.

If you are a Board member living in a condominium association in Missouri or any of the surrounding states that we cover, please feel free to reach out to Jim Ruebsam, Danny Dragicevic or Steve Doores for assistance. You can also find more information on aluminum wiring and proper remediation through the following web link on our new website: https://condoinsure.com/resources/aluminum-wiring-remediation/

If you have any immediate concerns or questions, please don’t hesitate to reach out to us.